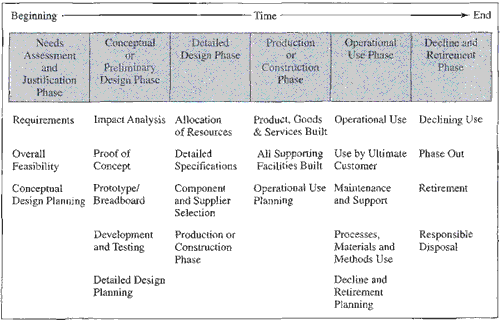

The products, goods, and services designed by engineers all progress through a life cyclevery much like the human life cycle. People are conceived, go through a growth phase, reach their peak during maturity, and then gradually decline and expire. The same general pattern holds for products, goods, and services. As with humans, the duration of the dif- ferent phases, the height of the peak at maturity, and the time of the onset of decline and termination all vary depending on the individual product, good, or service. Figure 2-3 illustrates the typical phases that a product, good or service progresses through over its life cycle.

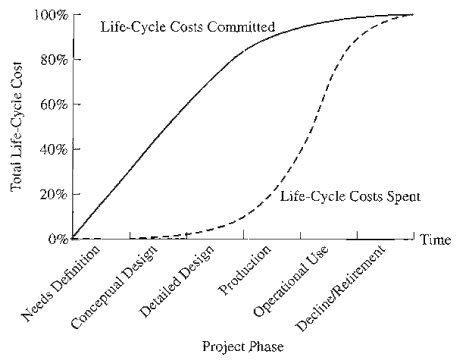

Life-cycle costing refers to the concept of designingproducts, goods, and serviceswith a full and explicit recognition of the associated costs over the various phases of their life cycles. Two key concepts in life-cycle costing are that the later design changes are made, the higher the costs, and that decisions made early in the life cycle tend to “lock in” costs that are incurred later. Figure 2-4 illustrates how costs are committed early in the product life cycle-nearly 70-90% of all costs are set during the design phases. At the same time, as the figure shows, only 10-30% of cumulative life-cycle costs have been spent.

Figure 2-5 reinforces these concepts by illustrating that downstreamproduct changes’ are more costly and that upstream changes are easier (and less costly) to make. When planners try to savemoney at an early design stage, the result is often a poor design, calling for change orders during construction and prototype development. These changes, in turn, are more costly than working out a better design would have been.

FromFigures2-4 and 2-5we seethe the time to consider all life-cycle effects, and make design changes, is during the needs and conceptual/preliminary design phases-before a lot of dollars are committed. Some of the life-cycle effects that engineers should considerate design time include product costs for liability, production, material, testing and quality assurance, and maintenance and warranty. Other life-cycle effects include product features based on customer input and product disposal effects on the environment. The key point is that engineers who design products and the systems that produce them should consider all life-cycle costs. . ..

A cash cost requires the cash transaction of dollars “out of one person’s pocket” into “the pocket of someone else.” When you buy dinner for your friends or make your monthly automobile payment you are incurring a cash cost or cash flow. Cash costs and cash flows are the basis for engineering economic analysis.

Book costs do not require the transaction of dollars “from one pocket to another.” Rather, book costs are cost effects from past decisions that are recorded “in the books” (accounting books) of a firm. In one common book cost, asset depreciation (which we discuss in Chapter 11), the expense paid for a particular business asset is “written off” on a company’s accounting sy’stemover a number of periods. Book costs do not ordinarily represent cash flows and thus are not included in engineering economic analysis. One exception to this is the impact of asset depreciation on tax payments-which are cash flows and are included in after-tax analyses.

Recurring and Nonrecurring Costs

Recurring costs refer to any expense that is known, anticipated, and occurs at regular intervals. Nonrecurring costs are one-of-a-kind expenses that occur at irregular intervals and thus are sometimes difficult to plan for or anticipate from a budgeting perspective.

Examples of recurring costs include those for resurfacing a highway and reshingling a roof. Annualexpenses formaintenance and operation are also recurring expenses.Examples of nonrecurring costs include the cost of installing a new machine (including any facility modifications required), the cost of augmenting equipment based on older technology to restore its usefulness, emergency maintenance expenses, and the disposal or close-down costs associatedwith ending operations.

In engineering economic analyses recurring costs a remodeled as cash flows that occur at regular intervals.(such as every year or every 5 years.) Their magnitude can be estimated, and they can be included in the overall analysis. Nonrecurring costs can be handled easily in our analysis if we are able to anticipate their timing and size. However, this is not always so easy to do.

An opportunity cost is associated with using a resource in one activity instead of another.

Every time we use a business resource (equipment, dollars,manpower, etc.) in one activity, we give up the opportunity to use the same resources at that time in some other activity.

Every day businesses use resources to accomplish various tasks-forklifts are used to transport materials, engineers are used to design products and processes, assembly lines are used to make a product, and parking lots are used to provide parking for employees’ vehicles. Each of these resources costs the company money to maintain for those intended purposes. However, that cost is not just made up of the dollar cost, it also includes the opportunity cost. Each resource that a firmowns can feasibly be used in several alternative

ways. For instance, the assembly line could produce a different product, and the parking lot could be rented out, used as a building site, or converted into a small airstrip. Each of these alternative uses would provide some benefit to the company.

A firmthat chooses to use the resource in one way is giving up the benefits that would be derived from using it in those other ways. The benefit that would be derived by using the resource in this “other activity” is the opportunity cost for using it in the chosen activity.Opportunity cost may also be considered a forgone opportunity cost because we are forgoing the benefit that could have been realized. A formal definition of opportunity cost might be:

An opportunity cost is the benefit that is forgone by engaging a business resource in a chosen activity instead of engaging that same resource in the forgone activity.

As an example, suppose that friends invite a college student to travel through Europe over the summer break. In considering the offer, the studentmight calculate all the out-of-pocket cash costs that would be incurred.

Cost estimates might be made for items such as air travel, lodging, meals, entertainment, and train passes. Suppose this amounts to $3000 for a to-week period. After checking his bank account, the student reports that indeed he can afford the $3000 trip. However, the true cost to the student includes not only his out-

of-pocket cash costs but also his opportunity cost. By taking the trip, the student is giving up the opportunity to earn $5000 as a summer intern at a local business. The student’s total cost will comprise the $3000 cash cost as well as the $5000 opportunity cost (wages forgone)-the total cost to our traveler is thus $8000.

A distributor of electric pumps must decide what to dowith a “lot” of old electric pumps purchased 3 years ago. Soon after the distributorpurchased the lot, technology advancesmade the old pumps less desirable to customers. The pumps are becoming more obsolescent as they sit in inventory.

The pricing manager has the following information.

Looking at the data, the pricing manager has concluded that the price should be set at $8000.

This is the money that the firmhas “tied up” in the lot of old pumps ($7000 purchase and $1OOO storge), and it was reasoned that the company should at least recover this costs. Furthermore, the pricing manager has argtied that an $8000 price would be $1500 less than the list price from 3 years ago, and it would be $4000 less than what a lot of new pumps would cost ($12,000 – $8000).What would be your advice on price?

Let’s look’more closely at each of the data items.

Distributor’s purchase price 3 years ago: This is a sunk cost that should not be considered in setting the price today.

Distributor’s storage costs to date: The storage costs for keeping the pumps in inventoryare sunk costs; that is, they have been paid. Hence they should not influence the pricing decision.

Distributor’s listprice 3 years ago: If there have been no willing buyers in the past 3 years at this price, it is unlikely that a buyer will emerge in the future. This past list price should have no influence on the current pricing decision. ~

Current listprice of newerpumps: Newer pumps now include technology and features that have made the older pumps less valuable. Directly comparing the older pumps to those with new technology is misleading.

However, the price of the new pumps and the value of the new features help determine the market value of the old pumps.

Amount offeredfrom a buyer 2 years ago: This is a forgone opportunity. At the time of the offer, the company chose to keep the lot and thus the $5000 offered became an opportunity cost for keeping the pumps. This amount should not influence the current pricing decision.

Current price the lot could bring: The price a willing buyer in the marketplace offers is called the asset’s market value. The lot of old pumps in question is believed to have a current market value of $3000.

From this analysis, it. is easy to see the flaw in the’ pricing manager’s reasoning. In an engineering economist analysis we deal only with today’s and prospectivefuture opportunities.

It is impossible to go back in time and change decisions that have been made. Thus, the pricing manager should recommend to the distributor that the price be set at the current value that a buyer assigns to the item: $3000.

A sunk cost is money already spent as a result of a past decision. Sunk costs should be disregarded in our engineering economic analysis because current decisions cannot change the past. For example, dollars spent last year to purchase new production machinery is money that is sunk: the money allocated to purchase the production machinery has already been spent-there is nothing that can be done now to change that action.

As engineering economists we deal with present and future opportunities.

Many times it is difficult not to be influenced by sunk costs. Consider 100 shares of stock in XYZ, Inc., purchased for $15 per share last year. The share price has steadily declined over the past 12months to a price of $10 per share today. Current decisions must focus on the $10 per share that could be attained today (as well as future price potential), not the $15 per share that was paid last year. The $15 per share paid last year is a sunk cost and has no influence on present opportunities.

As another example ,when Regina was a sophomore, shepurchased a newest-generation laptop from the college bookstore for $2000. By the time she graduated, the most anyone would pay her for the computer was $400 because the newest models were faster, cheaper and had more capabilities. For Regina the original purchase price was a sunk cost that has no influence on her present opportunity to sell the laptop at its current market value ($400).

Fixed, Variable, Marginal, and Average Costs: Examples

Evaluating a set of feasible alternatives requires that many costs be analyzed. Examples include costs for initial investment, new construction, facility modification, general labor, parts and materials, inspection and quality, contractor and subcontractor labor, training, computer hardware and software,material handling, fixturesand tooling, datamanagement, and technical support, aswell as general support costs (overhead). In this sectionwedescribe several concepts for classifying and understanding these costs.

⇒Fixed, Variable, Marginal, and Average Costs: Examples.

⇒Sunk Costs.

⇒Opportunity Costs.

⇒Recurring and Nonrecurring Costs.

⇒Cash Costs Versus Book Costs.

⇒Life-Cycle Costs.

Engineering Costs and Cost Estimating: Webvan Hits the Skids.

Webvan, an on-line supermarket, aimed to revolutionize the humdrum business of selling groceries. Consumers could order their weekly provisions with a few clicks and have the goods delivered right to their door. It sounded like a great business plan, and the company had no trouble attracting capital during the dotcom boom of the late 1990s.Eager investors happily poured hundreds of millions into the company. With that kind of money to spend, Webvan invested lavishly in building infrastructure, including large warehouses capable of filling 8000 orders a day. The firm rapidly expanded to servemultiple cities nationwide and even acquired a competing on-line company, Home Grocer.

But the hoped-for volume of customers never materialized. By early 2000, Internet grocers hadmanaged to capture only a small part of the food salesmarket-far short of the 20%they had anticipated. When the dotcom boom went bust, Webvan suddenly looked much less attractiveto investors,who quickly snapped their wallets shut.

Without new money coming in ,Webvan suddenly had to face an uncomfortable fact: it was spending far more than it was earning. Finally, in 2001, Webvan went bankrupt. A rival on-line grocer, Peapod, narrowly escaped the same fate-but only because a Dutch retailer was willing to buy the company and continue pumping money into it. Interestingly, at the same time Webvanwas burning through millions in dotcom cash, a bricks-and-mortar supermarket chain in Britain called Tesco also decided to get into the on-line grocery business. Tesco invested around $56 million in a computerized processing system and, instead of building warehouses, had employees in each store walk the aisles filling orders. Unlike Webvan, Tescomade a profit.

Leverage your subject expertise to grow skills & earn a stable income through academic help. Build a better future for yourself .www.eagletutor.in